Corporate Finance

Corporate Finance is an umbrella which practically covers every aspect of Finance in a Corporates life.

- Capital Structuring: Optimum capital structuring is Aimed at maximising value for stakeholders of the corporate through long and short term financial planning and implementation of strategies.

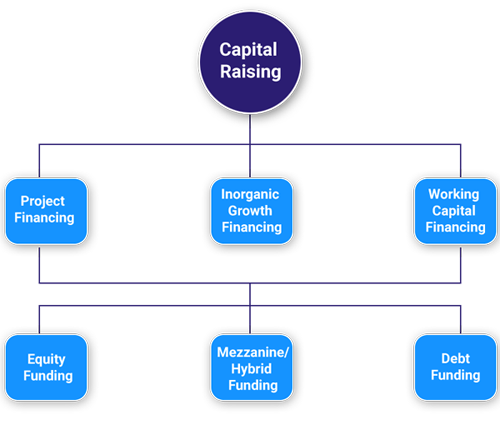

- Funding Sources: The choice of funding source (Debt, Equity or Mezzanine Finance) is extremely important as it impacts the company on various fronts, right from cost of capital to liquidity position of the corporate.

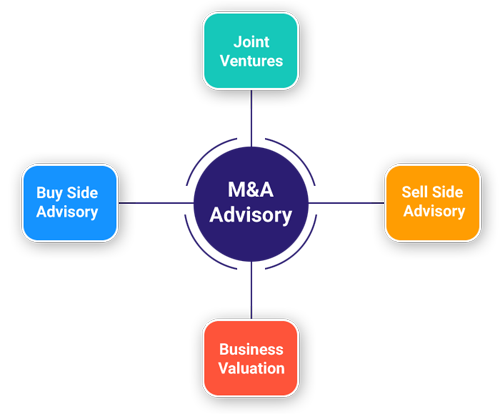

- Investment Decisions: The option chosen by a corporate while it decides to carry-out a new Capex or a replacement project or an acquisition impacts the short term as well as long term growth prospects of that corporate.

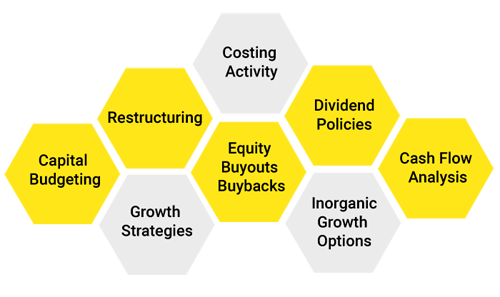

Provalue helps companies across a large basket of services under corporate finance